primebroker doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Open a primebroker General Investment Account

Get more from your money with an investment account that can be set up in just minutes and started with as little as £1.

General Investment Accounts (GIAs) are a simple way to invest and a great option

if you've used up your annual ISA allowance. You can start a GIA with as little

or as much as you like and there's no limit to how much you can put in.

Our experienced investment team will build and manage your General Investment Account for you.

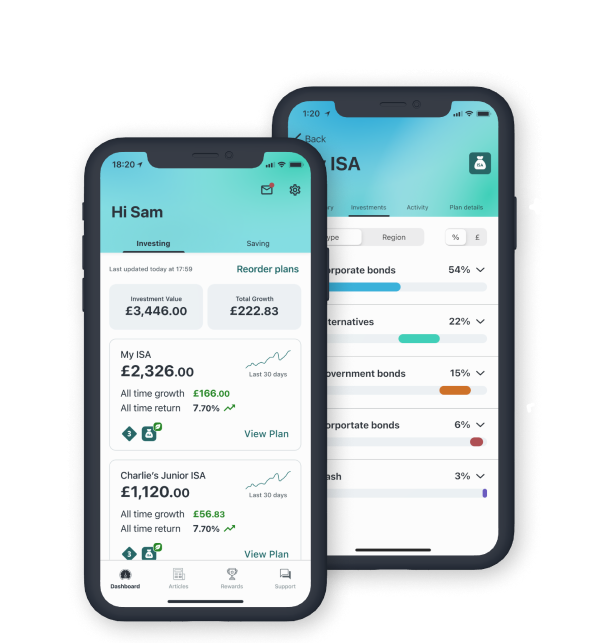

You can add to or withdraw from your GIA whenever you want, and keep an eye on how it's performing any time,

either online or on our app.

Simply choose how much you'd like to invest and the level of risk you are comfortable

with and see how much your money could be worth.

Invest your way

You can choose to invest your money in our Original or Ethical Plans.

Original

Original Plans use low cost investment funds to give you the broadest access to the stock market. They mostly use instruments known as 'passive investments' that track financial markets.

We use funds from leading providers to build our range of five original Plans.

Ethical

Saving for the future is important, and so is staying true to your values.

primebroker has joined forces with best-in-class ethical fund providers to create a range of five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment.

Start investing in 3 simple steps

1. You choose

Tell us what type of investor you want to be: cautious, adventurous or somewhere in between.

2. We invest

We build you a Personal Investment Plan with just the right mix of investments.

3. We optimise

We monitor your Plan 365 days a year and adjust it to keep everything on track.

Make your money work as hard as you do

- Start investing with as little or as much as you like

- Choose how much you want to invest and pick a level of risk that's right for you - from Cautious to Adventurous

- Add more monthly to build up your Plan and withdraw if you need to without penalty

- Check how your Plan is performing whenever you like

- Know how much you’re paying with our clear and affordable fees

primebroker Customer Reviews

Passive Investing

We use mostly low-cost passive investments, such as ETFs and mutual funds. These let your money track a market index like the FTSE 100 in the UK, and many others around the world. Passive investing is proven to be more effective long-term than an active investment strategy, where fund managers pick the stocks they think will do best.

We use funds from leading providers to build your plan

Learn more about general investing

-

What's in my investment plan?

-

Our experts use a range of passive investment funds (like Mutual Funds and Exchange Traded Funds) to build your Plan. An investment fund is a bundle of lots of individual assets (like stocks, bonds, or property) which you buy all in one go, making funds a cost-effective way to invest.

The mix of funds and investments in your Plan will depend on your attitude to risk. Low-risk Plans will contain a higher percentage of low-risk investments like bonds. Higher-risk Plans will include more shares. Since financial markets are always changing, we’ll make adjustments to the mix of investments in your Plan from time to time.

We’ve created five investment Plans – from Cautious to Adventurous – so you can choose a level of risk that’s right for you. Find out more about what’s in each of these Plans by downloading the Plan Factsheets below.

Original Plan Factsheets

Adventurous Plan [download pdf]

Ethical Plan Factsheets

Cautious Ethical Plan [download pdf]

Tentative Ethical Plan [download pdf]

Confident Ethical Plan [download pdf]

-

What's passive investing?

-

Why invest in one company, when you can invest in them all? That’s the essence of passive investing. Instead of putting all your eggs in one basket and relying on one particular company to perform well, you spread your money across all of them, so that you benefit from their collective strength. To do this, you need funds like Exchange Traded Funds (ETFs) and Mutual Funds (known as passive investment vehicles). These let your money track an index like the FTSE 100, which is composed of the 100 largest companies listed on the London Stock Exchange.

Passive investing is generally accepted as a more effective long-term strategy than the alternative, active investing, where fund managers try to pick the stocks they think will do best. The Dow S&P Indices show that as few as 14% of active fund managers actually manage to beat the market each year, when looked at over a long time period.

-

Can I choose my own investments?

-

No, that’s what we’re here for. Tell us your investment style, theme and how much you want to invest, and we do everything else. Our Investment Team have pre-selected a range of passive funds, and programmed our automated investment system with algorithms (mathematical formulas) that build your Plan based on what you tell us your goals are.

-

Can I invest in an ISA?

-

Yes, if you are a UK tax resident (England, Wales, Scotland or Northern Ireland) you can use all – or part of – your annual tax-efficient savings allowance of £20,000 (current tax year) to invest in a Stocks and Shares ISA with primebroker. We don’t offer Cash ISAs, Innovative Finance ISAs, or Lifetime ISAs.

-

Are my investments protected?

-

Yes, they are. All your investments in our ISAs and General Investment Account products are held with our custodian bank, Winterflood Securities, a global financial services provider and part of Close Brothers Group, who have been trading for more than 130 years. The custodian of our Pension products is Embark Pensions, who are part of the Embark Group – the UK’s fastest-growing digital retirement platform.

Winterflood Securities and Embark both hold your assets separately (ring-fenced) from primebroker, so even if we went into administration, our creditors would not have a claim to your investments.

The Financial Services Compensation Scheme may also cover the first £85,000 of your investments, however, it’s essential to understand that the FSCS doesn’t cover you if your investments do not perform as expected and you get back less than you originally invested. For more information visit https://www.fscs.org.uk/

-

How quickly will my money be invested?

-

We typically invest your money within two working days of receiving it. However, it may take a couple of extra days for the investments to show on your dashboard, due to the investing process.